Specialist Guide to Ending Up Being an Independent Insurer in the Insurance Policy Industry

Beginning on an occupation as an independent insurer within the insurance policy sector requires a thorough understanding of the detailed operations of this customized area. From developing necessary abilities to acquiring the essential licensure, the trip to coming to be an effective independent adjuster is diverse and needs a tactical technique.

Understanding the Independent Insurance Adjuster Duty

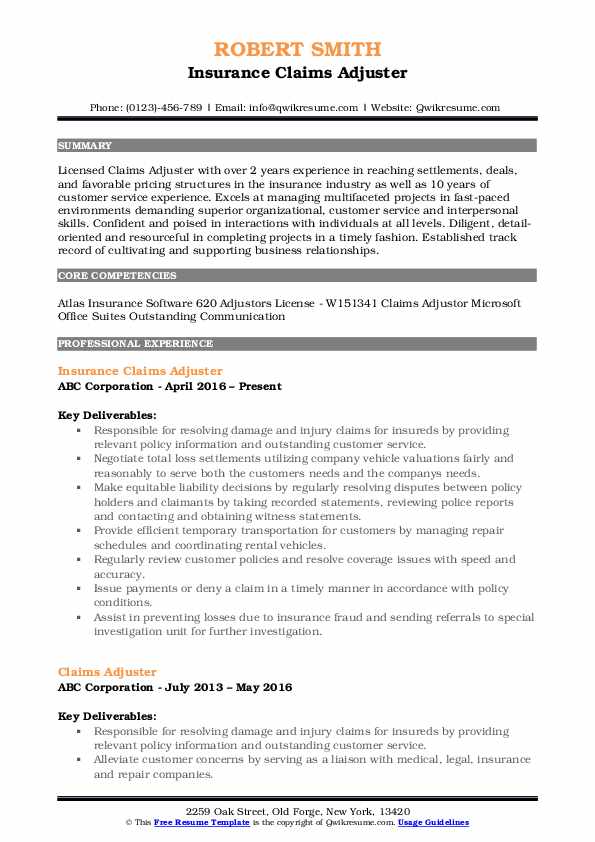

Comprehending the duty of an independent insurer includes carefully reviewing insurance policy cases to establish accurate negotiations. Independent adjusters play an important duty in the insurance policy market by exploring insurance claims, assessing policy information, examining property damages, and assessing the extent of coverage. These experts work as neutral 3rd parties, dealing with behalf of insurer to make sure timely and reasonable case resolutions.

In order to accurately evaluate claims, independent insurance adjusters need to possess a strong focus to detail, logical abilities, and a deep understanding of insurance coverage policies and guidelines. They must very carefully examine documentation, gather proof, and meeting appropriate celebrations to make educated choices concerning insurance claim settlements. Independent insurance adjusters also require outstanding communication abilities to efficiently work out with claimants, insurance coverage firms, and various other stakeholders included in the cases procedure.

Necessary Abilities and Credentials

Possessing a diverse collection of abilities and certifications is essential for people intending to stand out as independent adjusters in the insurance policy sector. Independent insurers need to have excellent communication abilities to effectively communicate with customers, insurance coverage companies, and various other specialists in the field.

Moreover, having a solid understanding of insurance coverage legislations, procedures, and concepts is necessary for independent adjusters to browse complex insurance claims processes effectively. independent adjuster firms. Proficiency in computer software program and technology is significantly essential for managing claims successfully and keeping precise documents

A background in finance, business, or a relevant field can offer a strong structure for aiming independent adjusters. Obtaining appropriate accreditations, such as the Accredited Claims Insurer (ACA) classification, can additionally enhance reputation and demonstrate a commitment to professional development in the insurance coverage market. By sharpening these important skills and certifications, people can position themselves for success as independent insurance adjusters.

Browsing Licensing and Qualification

Having actually acquired the important skills and certifications needed for success as an independent insurance adjuster in the insurance policy sector, the following crucial step involves navigating the ins and outs of licensing and qualification needs. In the USA, independent adjusters are usually needed to get a license in each state where they intend to function. The specific requirements for licensure vary from state to state however commonly consist of finishing a pre-licensing education and learning course, passing a licensing exam, and going through a background check. Some states may additionally need insurance adjusters to satisfy continuing education and learning demands to maintain their licenses.

Organizations such as the National Association of Independent Insurance Coverage Adjusters (NAIIA) and the American Institute for Chartered Residential Property Casualty Underwriters (AICPCU) offer accreditation programs that cover different facets of the readjusting procedure. By understanding and satisfying the licensing and qualification requirements, independent insurance adjusters can place themselves for success in the insurance policy industry.

Structure Your Adjusting Profile

To develop a solid structure for your job as an independent adjuster in the insurance industry, concentrate on developing a robust adjusting portfolio. Your have a peek at these guys adjusting portfolio must display your abilities, experience, and competence in taking care of insurance claims efficiently and effectively. Include information of the kinds of cases you have actually serviced, such as residential or commercial property liability, damage, or auto crashes, and highlight any kind of specialized knowledge you have, like managing claims in particular industries or areas.

When constructing your adjusting portfolio, consider including any type of appropriate certifications, licenses, or training you have finished. This will certainly show your dedication to specialist growth and your reliability as an adjuster. In addition, consisting of testimonies or references from previous customers or employers can aid verify your abilities and dependability as an independent adjuster.

Routinely upgrade your changing profile with new experiences and accomplishments to ensure it continues to be reflective and existing of your abilities. A thorough and well-organized adjusting profile will not just attract possible clients however also assist you stand out in an affordable insurance market.

Networking and Finding Opportunities

Establishing a solid professional network is necessary for independent adjusters wanting to locate new chances and increase their client base in the insurance coverage industry. Networking permits insurance adjusters to attach with essential sector professionals, such as insurance policy carriers, declares supervisors, and various other insurers, which can lead to recommendations and new tasks. Participating in sector events, such as workshops and conferences, provides useful networking possibilities where adjusters can meet prospective customers and discover arising trends in the insurance coverage field.

Final Thought

Finally, aspiring independent adjusters need to possess crucial abilities and certifications, navigate licensing and certification needs, build a strong adjusting portfolio, and actively network to find opportunities in the insurance coverage market. By comprehending the function, developing required skills, obtaining proper licensing, and building a solid profile, people can place themselves for success as independent insurance adjusters. Networking is likewise vital in broadening one's chances and establishing a successful job in this area.

Independent insurers play check this site out a crucial duty in the insurance policy market by exploring claims, reviewing policy information, evaluating building damages, and examining the degree of coverage.Possessing a diverse set of skills and certifications is imperative for individuals intending to excel as independent insurers in the insurance policy market.Having acquired the necessary abilities and credentials needed for success as an independent adjuster in the insurance sector, the following important step entails navigating the intricacies of licensing and qualification demands. Networking permits insurance adjusters to attach with essential sector professionals, such as insurance policy carriers, asserts managers, and other insurers, which can lead to referrals and brand-new projects.In verdict, aspiring independent insurance adjusters must possess important abilities and qualifications, browse licensing and qualification requirements, develop a solid adjusting portfolio, and actively network to discover possibilities in the insurance market.

Comments on “Navigating Insurance Policy Claims: The Role of Independent Adjuster Firms”